-

- 메일앱이 동작하지 않는 경우

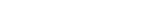

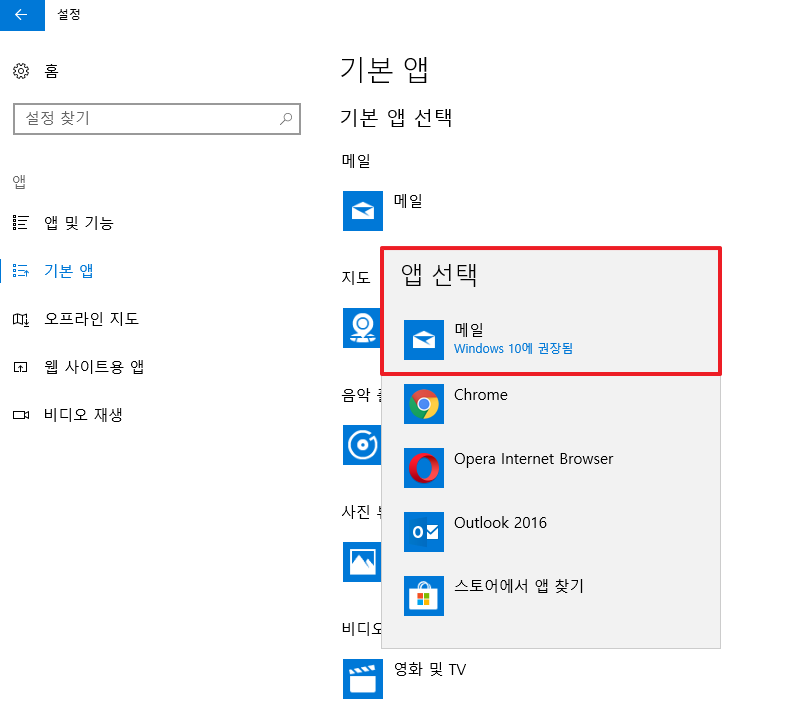

- Window 설정 > 앱 > 기본앱 > 메일에서 메일앱으로 변경

- [해운물류 > 해운빅데이터연구센터]2016-12-02 13:10:56/ 조회수 4820

-

◎ 유조선 공급과잉 우려 제기

- 평가덧글

- 인쇄보내기

- ◎ 유조선 공급과잉 우려 제기

선복량 대비 발주량 비중이 최대 19%(Suezmax)까지 도달

적극적인 해체 시나리오(Poten社) 적용해도 인도량이 해체량의 2배

Oversupply could be looming for the tanker market if scrapping numbers aren’t increased

With an orderbook reaching up to 19% in the case of Suezmaxes, it’s only natural that some tankers are starting to feel pressured over the course of the market during the next couple of years. In a recent note, shipbroker Poten said that over the next couple of years, the tanker orderbook ranges from 5% in the case of Handies and up to 19% for Suezmaxes, which begs the question, if scrapping activity, which has been non existent this year, should soon start to pick up.

According to Poten, if overcapacity makes a return, then rates are bound to fall, which will then prompt more owners to scrap their older vessels. As things stand right now though, the majority of analysts seem to agree that in the coming years, supply growth will increase considerably, when, at the same time, demand growth is projected to increase mildly. To evaluate the potential of demolition activity, Poten attempted to evaluate what is the number of vessels which could be considered scrapping candidates.

Poten said that “in recent years, tanker sales for scrap have been few and far between and the average age of tankers that are sold for demolition is well above 20 years. The most recent tanker that was sent to the breakers (in October), the VLCC MT Progress, was built in 1994. Before that, – in September – the 45,000 dwt MR product carrier MT Zeta was sold to buyers in Pakistan. This vessel was 28 years old (built in 1988)”. The shipbroker added that “for the purpose of this analysis, we will look at how many vessels would be scrapped over the next two years (through the end of 2018) if we used a fixed scrapping age of 20 years and how these numbers compare with the current orderbook for delivery in the same period. For most segments – the orderbook well exceeds scrapping under this scenario. The segments that appear the most worrisome are the VLCCs and Suezmaxes”, said Poten.

It’s worth noting that even under this relatively aggressive scrapping scenario (most tankers trade well beyond 20 years old), the scheduled deliveries in these segments are almost double the demolition numbers. “The numbers for the large product tankers (LR1 and LR2) don’t look encouraging either, but here we have to note that we need to review these segments in combination with their sister vessels in the crude trade (Aframax and Panamax)”, said the shipbroker. Poten estimates that the Aframax crude tanker fleet will likely stop growing in the next few years, while the “dirty” Panamax segment is already shrinking as owners opt to build coated vessels to give themselves more trading flexibility and take advantage of the growth in long haul product movements.

Meanwhile, “for MR and Handysize product tankers, the numbers look more encouraging, although it should be noted that a 20 year scrapping age is quite optimistic for these vessels. Smaller product carriers typically trade well beyond 25 years of age. How about the employment patterns of the older tonnage? Many of the older vessels are underutilized, have trading restrictions and/or are being used for floating storage. A freshly delivered newbuilding will be significantly more productive than the old vessel it replaces. There is also demand growth that we need to consider. While we don’t know what tanker demand growth will be in 2017 and 2018, we can take a look at developments in 2016 to date as an indication”, said Poten.

“Our analysis of the crude oil and dirty product trade shows ton mile demand growth of 4.2% year to date, a number that (if continued) will help defray the impact of the significant fleet growth. While we don’t have the same data for the growth in all product sectors, expansion in ton mile demand for the LR1 and LR2 product carriers has been around 1.5-2% so far this year, well below the expected fleet expansion. The outlook for MR and Handysize product tankers appears brighter. The limited fleet growth in these segments will sow the seeds of a recovery in the coming years. So, the expected fleet growth may not be as disastrous for the market as it appears at first glance, if we continue to experience healthy growth in tanker ton mile demand, and if scrapping will pick up in the next few years. These are obviously ‘Big Ifs’. We will continue to follow the market closely to see whether these conditions are met”, Poten concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

원문보기

http://www.hellenicshippingnews.com/oversupply-could-be-looming-for-the-tanker-market-if-scrapping-numbers-arent-increased/